Подробнее об особенностях работы умной аналитики SellerStats для каждого из маркетплейсов — на сайте

В мире дизайна интерьера наблюдается постоянное обновление тенденций, отражающих изменения в предпочтениях и технологиях.

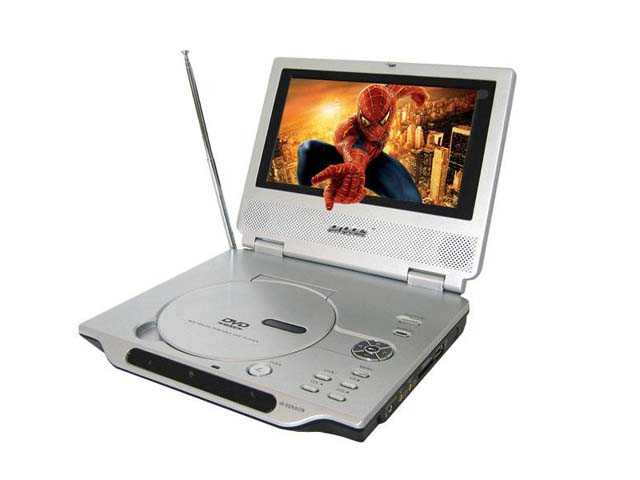

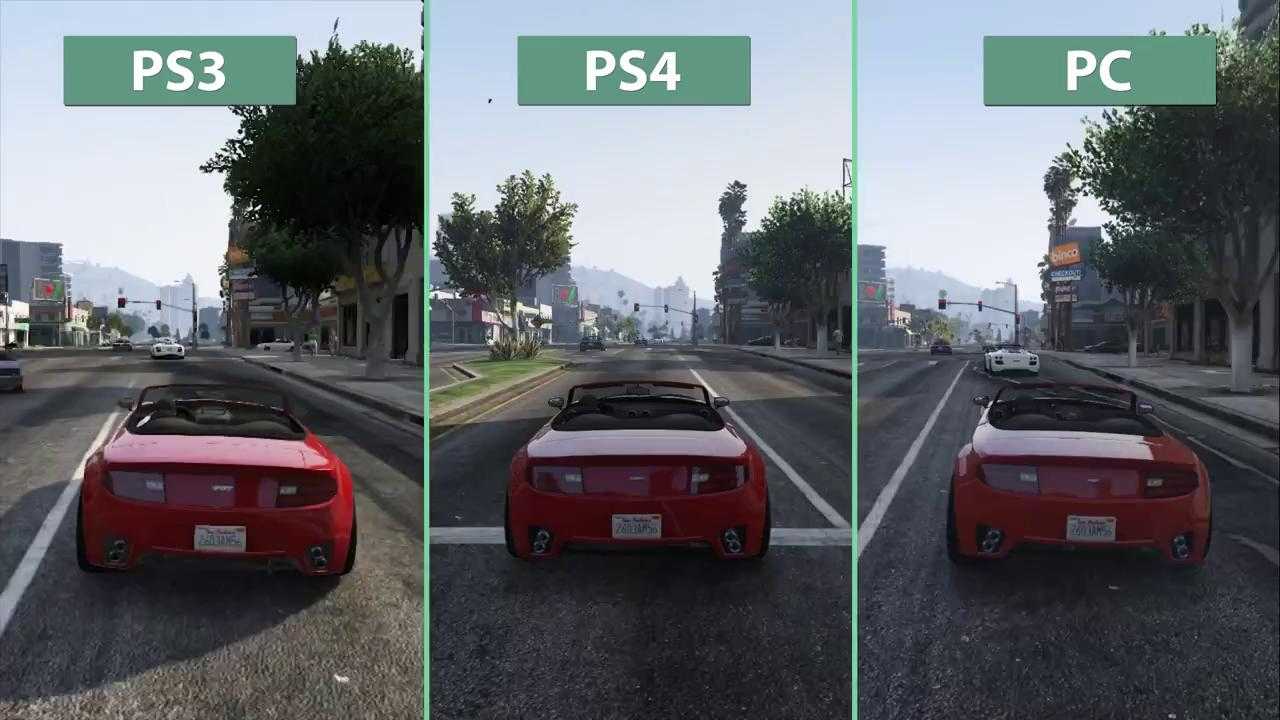

Мы живем в потрясающее время, когда 4K-телевизоры перестали быть чем-то недосягаемым. Цены на них

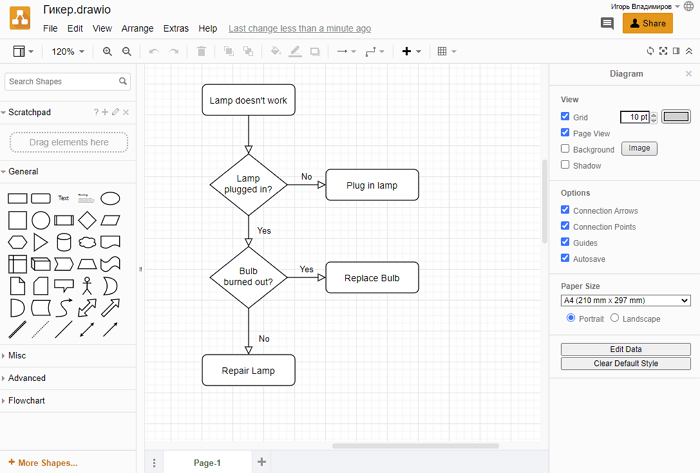

Редакция highload.today разобралась, что такое блок схемы, и с помощью каких сервисов их можно

Что такое саундбар, каковы его преимущества и недостатки. Особенности использования домашнего кинотеатра. Что лучше

Бытовые сигнализаторы угарного газа с сигнализацией. Применение в банях, палатках, быту и на различных

При настройке аудиосистемы многие люди предпочитают сравнивать PCM и Bitstream. Вот подробное руководство для

Представляем наш рейтинг ТОП 7 лучших изогнутых мониторов 2019 - 2020 года! Отзывы, цены,

Ищете лучшие медиаплееры для вашего компьютера с Windows 10 в 2021 году? Вот самые

В нашем рейтинге собраны лучшие модели беспроводных зарядок для телефона 2021 года. Ознакомившись с

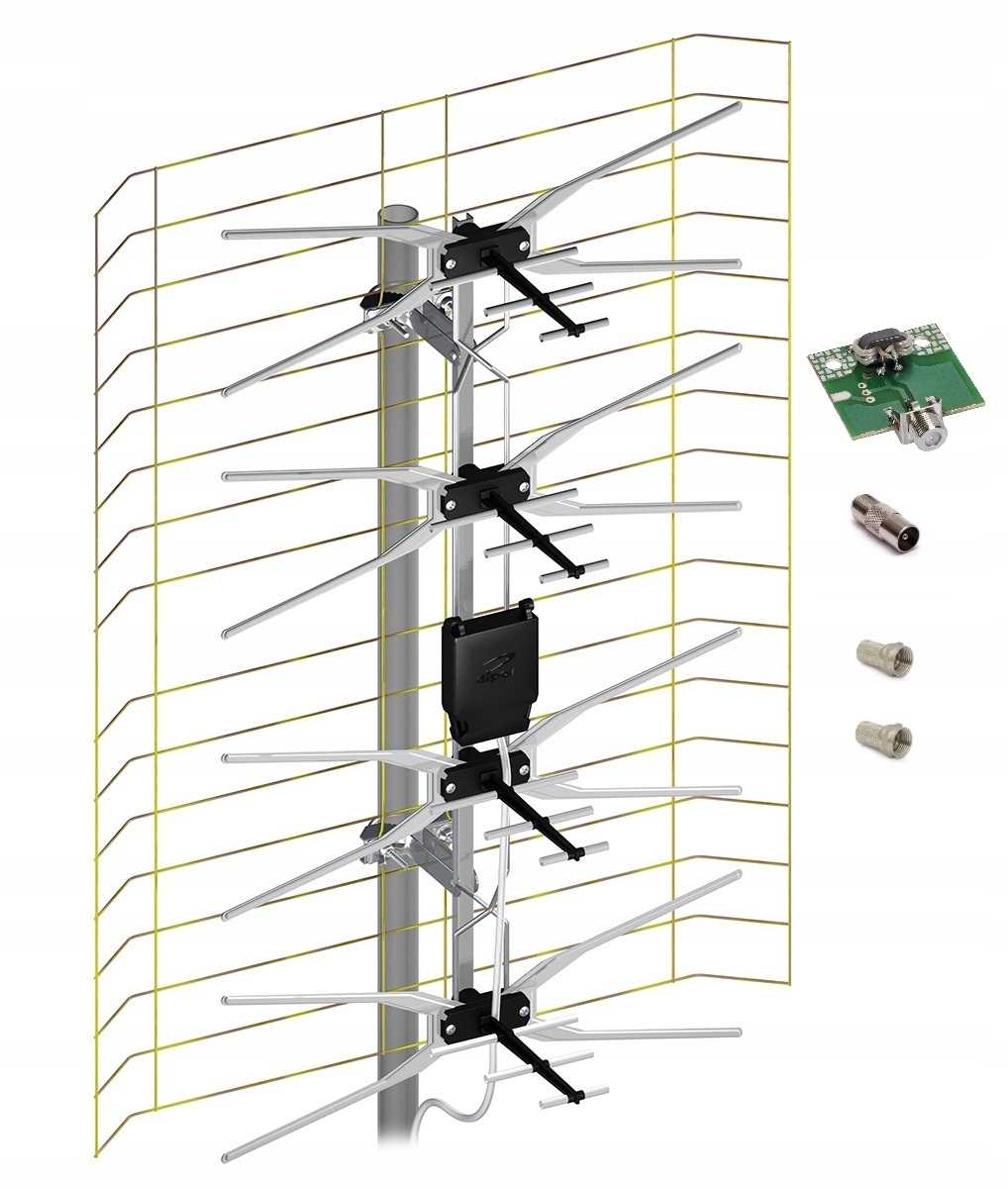

Рейтинг лучших антенн для цифрового ТВ 2021 года по мнению покупателей. Лучшие модели по

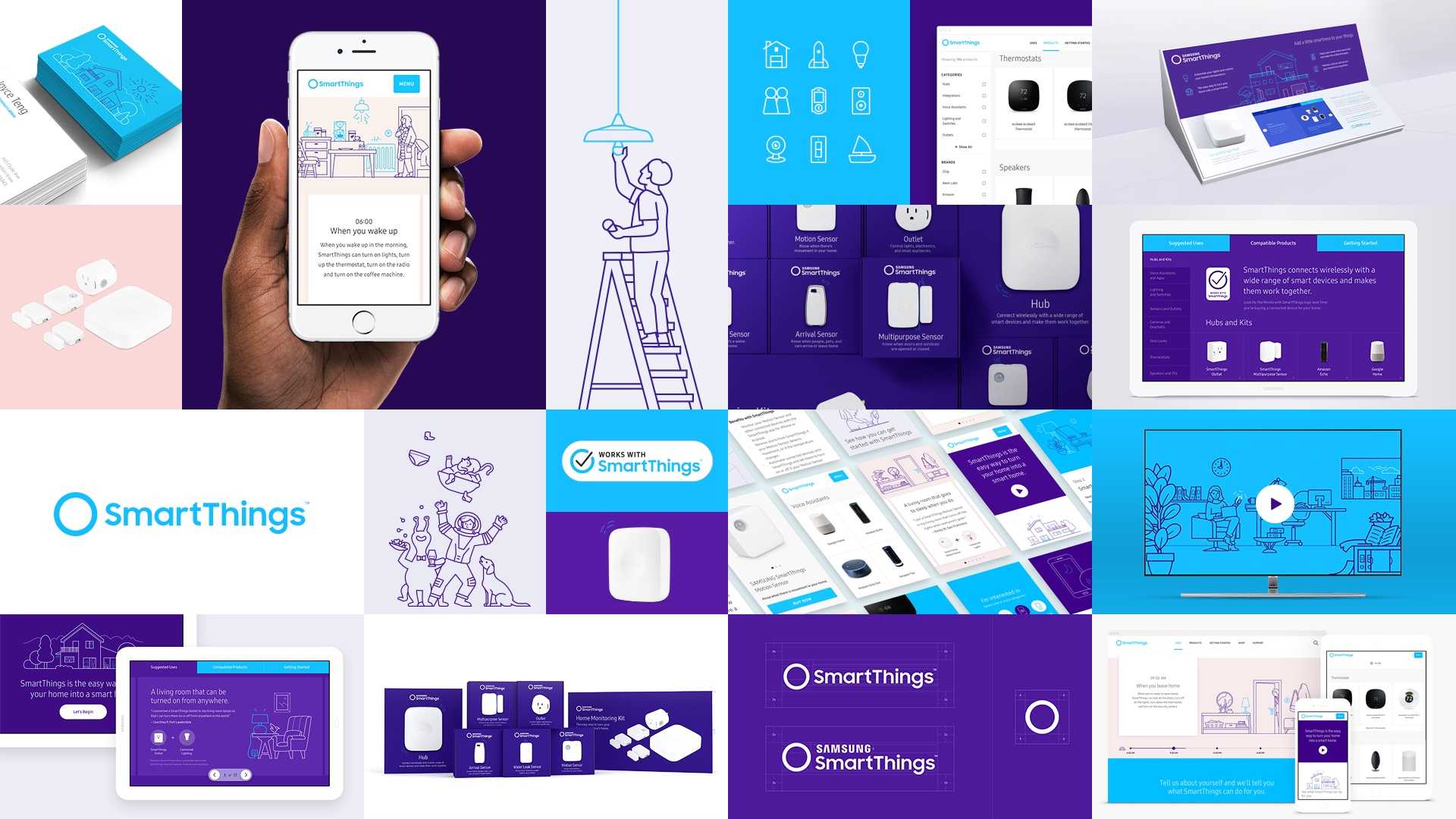

Что такой умный замок (смарт замок). Особенности умных замков и принцип работы. Плюсы и

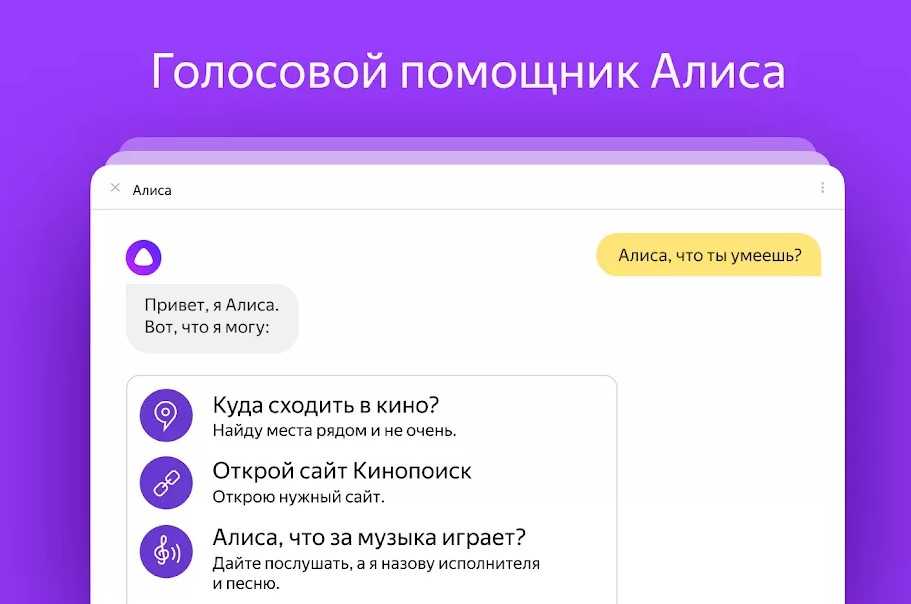

Обзор и рейтинг лучших голосовых помощников. Технологичные ассистенты для Андроид, iOS и ПК. Помощники

Здесь представлены основные форматы многоканального звука для домашних кинотеатров: Dolby ProLogic, Dolby Digital (АС-3),

XBOX 360 звук 5.1. Как подключить звук 5.1 xbox. PS3 вывод звука 5.1. PS3

Что такое умная кровать? Умная кровать — это кровать, в которой используются датчики и

Рейтинг лучших умных дисплеев 2020 года. Самое привлекательное устройство для большинства покупателей, лучшая цифровая

Динамики овальной формы, типоразмера 6 х 9 дюймов, так называемые «блины» — одни из

Lenovo Smart Display 7 - отличная альтернатива Google Nest Hub. Что их отличает? У

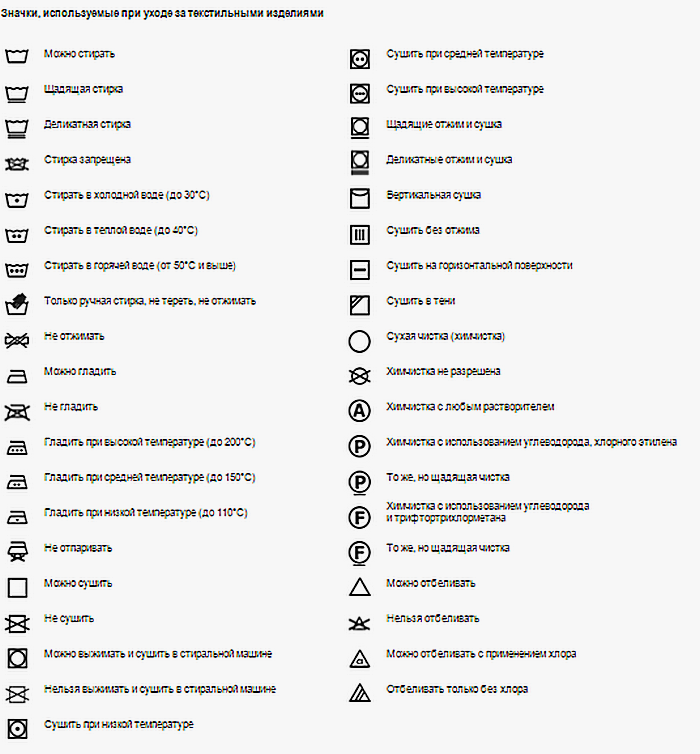

Расшифровываем смысл и учимся использовать по назначению. Даже если вы не из тех, кто

Это руководство по языку Twitter определяет сленг и жаргон твитов на простом английском языке.

Что означают значки в Инстаграме. Подробная расшифровка значков в Инстаграме, описание функций, инструкция по

Ниже разберём, какой конвертер онлайн позволит нам получить изображение TIFF 300 DPI, использующеся для

Самые популярные смайлы и их значения. Концепция и значение. Самые популярные смайлы и их

В Snapchat есть фантастические фильтры на любой случай, будь то произвести впечатление на девушку

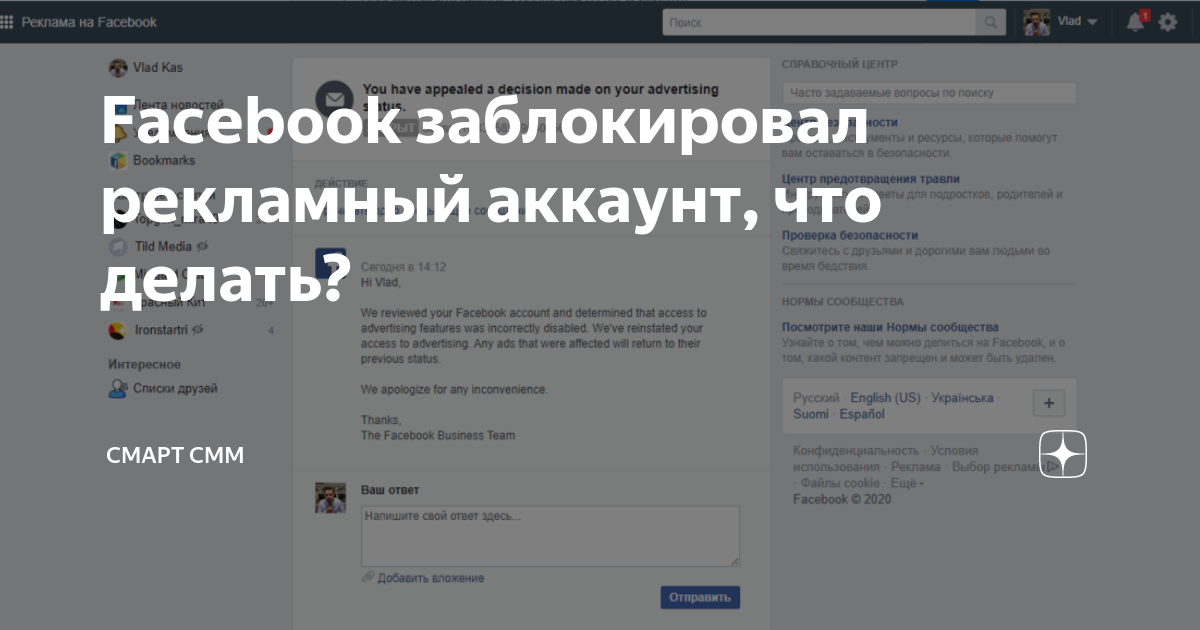

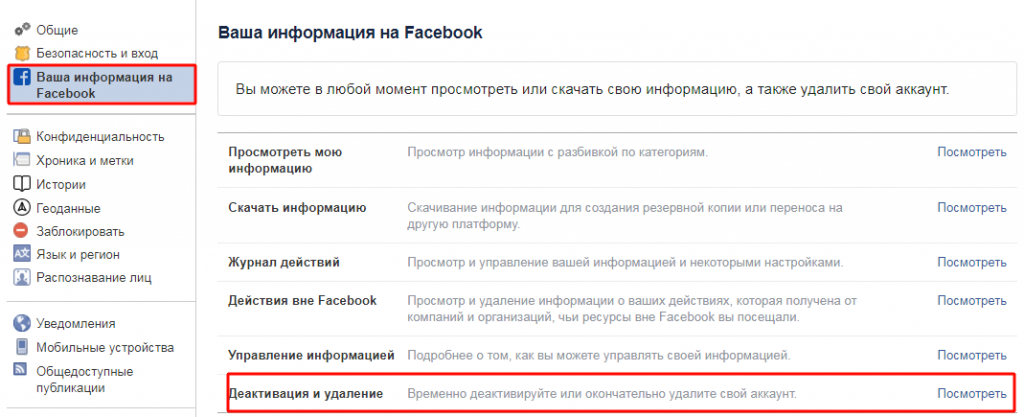

В этой статье мы расскажем вам, что такое Фейсбук и дадим инструкцию, как его

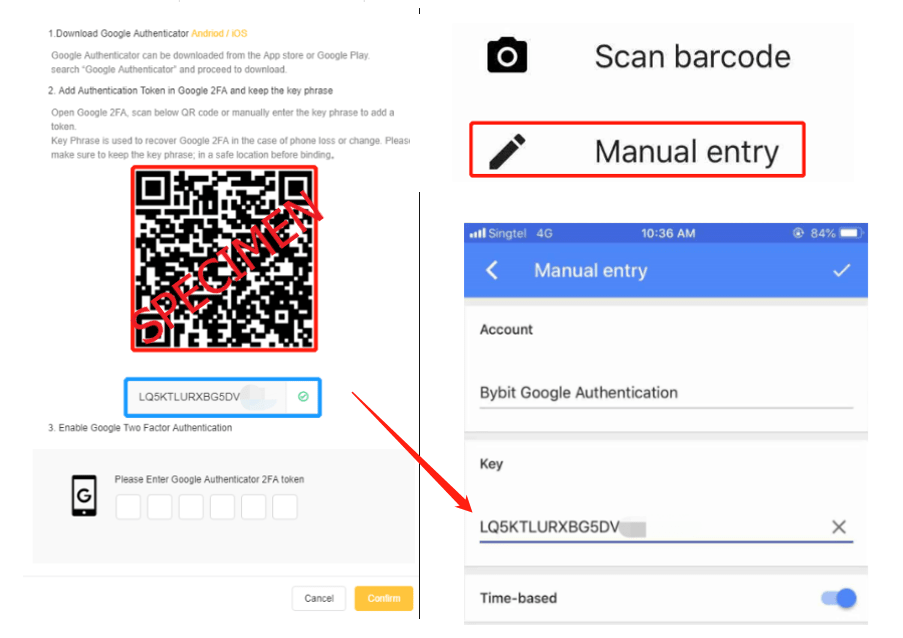

Проблемы при использовании Google Authenticator ✅ Восстановление Google Authenticator ✅ Сброс двухфакторной аутентификации ✅

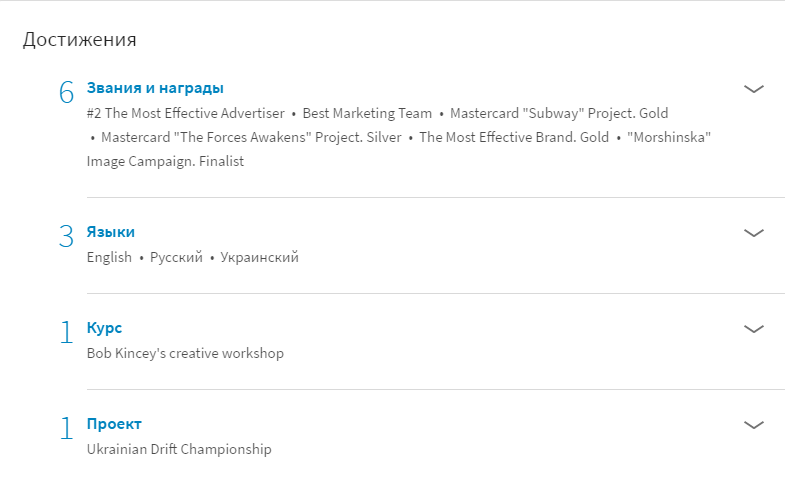

Чтобы LinkedIn-профиль был действительно полезным и приносил его владельцу бонусы в виде приглашений на

Какие навыки важны для работодателя? Сколько и где их разместить в резюме? Что делать,